In his first Western interview on 60 Minutes this weekend, Saudi Arabia’s Crown Prince Mohammed bin Salman warned that oil prices will soar unless global action is taken against Iran.

“If the world does not take a strong and firm action to deter Iran, we will see further escalations that will threaten world interests,” the crown prince told Norah O’Donnell.

“Oil supplies will be disrupted and oil prices will jump to unimaginably high numbers that we haven’t seen in our lifetimes.”

The September 14 drone attack against two of Saudi Aramco’s largest oil facilities, which temporarily shut down about 5% of global production and was widely blamed on Iran, serves as evidence for the crown prince’s stance against Iran.

The Middle East, he says, “represents about 30% of the world’s energy supplies, about 20% of global trade passages, about 4% of the world GDP. Imagine all of these three things stop. This means a total collapse of the global economy, and not just Saudi Arabia or the Middle East countries.”

MBS gives us some idea of potentially stark scenarios. But we really need to take some his comments with a grain of salt.

It’s true that the Middle East does provide roughly a third of the world’s oil needs. But that includes the entire region. And while tensions could mount into a ground war over Iran, it’s very unlikely a war would halt all Middle East oil exports from the region.

But let’s just say MBS’s worst-case scenario happens: Ground war halts all Middle East oil supply.

What’s next?

Well, oil prices skyrocket for sure.

The media frenzy over such a scenario would drive oil prices insanely higher. There’s no doubt about that. I’m guessing well over $100 per barrel. Maybe even $150.

And, of course, Trump would break a thumb tweeting. You’d have the “I told ya so” guys all over Fox News. Your local news would report on gas prices three times an hour. Greta Thunberg would get involved somehow.

But then…

Then oil prices would quickly pull back.

I think we’d see a big jump in prices initially but a significant pullback once the media frenzy cooled off. And that’s because everyone will remember this…

There’s another major oil producer in the game these days: the United States.

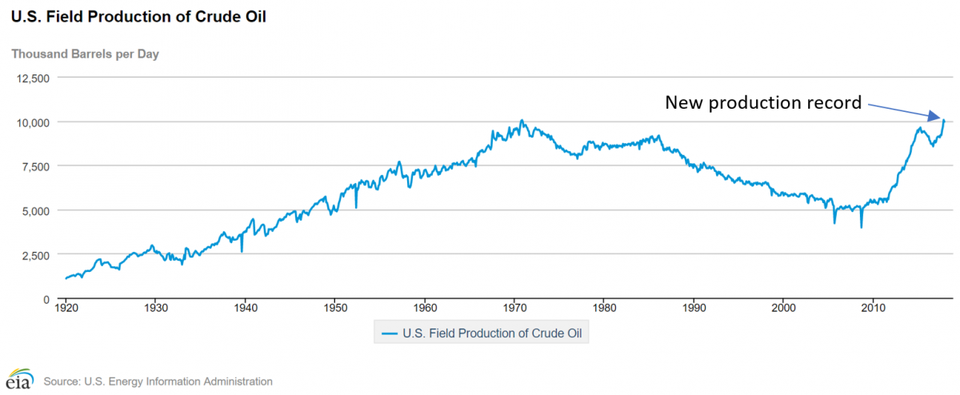

Between 1970 and the early 2000s, U.S. oil production was falling. In 2008, American oil production actually fell to its lowest point since the 1950s.

But since then, U.S. oil production has increased with the shale and tight oil boom. And today America is producing more oil than ever.

At over 15.5 million barrels of production per day, the United States is currently the world’s largest oil producer.

It’s also the world’s largest oil consumer. America consumes a little over 20 million barrels of oil per day. So the United States isn’t completely energy independent. But it’s closer than it has ever been.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

So, yeah, there’s no doubt that if Middle East oil supplies were to suddenly dry up over night, oil prices would initially soar. But the market would eventually rationalize that the Middle East isn’t as important to oil prices as it once was.

And ultimately, that’s what I think this whole 60 Minutes interview was about: MBS trying to remind the world that Middle East oil is important.

That’s very important to MBS and Saudi Arabia as the nation prepares its Saudi Aramco IPO.

But it’s also very important to OPEC. As we’ve talked about before, the 15-nation cartel has lost a lot of its influence in the past two years.

At the end of the day, MBS went on 60 Minutes to promote the relevance of Middle East oil supplies. Using the September 14 attack as fodder, he wants to remind you that OPEC is still important.

And the truth is: It is. But it’s not as important as it once was. Probably not important enough to make oil price jump “unimaginably” high.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.